ETH Price Prediction: Technical and Fundamental Factors Point to Continued Growth

#ETH

- Technical Strength: ETH trades 25% above its 20MA with bullish Bollinger Band positioning

- Network Upgrade: Gas limit increase improves Ethereum's transaction capacity

- Institutional Catalyst: BlackRock's staking proposal could drive next leg up

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Emerge

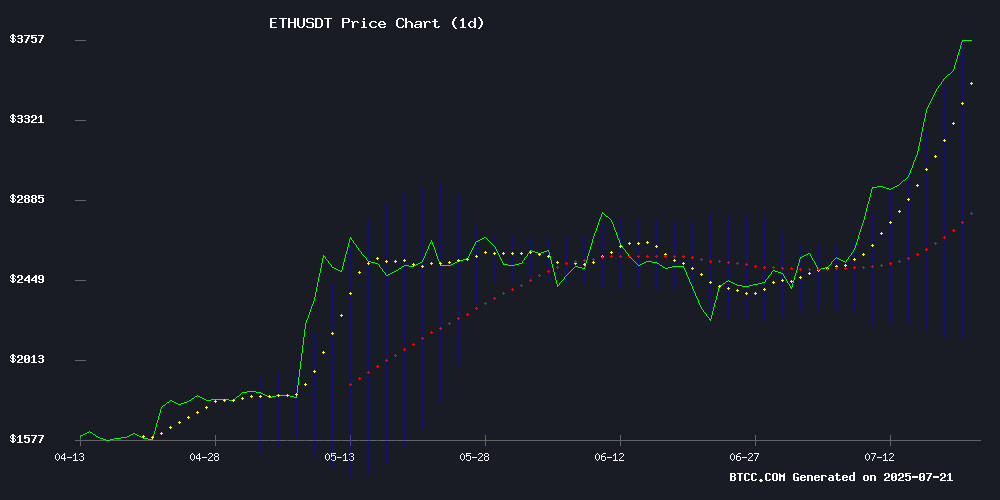

ETH is currently trading at $3,786.52, significantly above its 20-day moving average of $3,009.47, indicating strong bullish momentum. The MACD histogram shows decreasing bearish momentum (-169.58), while price sits NEAR the upper Bollinger Band ($3,864.43) - typically a sign of overbought conditions that may precede consolidation.

"The technical setup suggests ETH could test the $4,000 psychological resistance," says BTCC analyst Emma. "However, traders should watch for potential mean reversion toward the middle band at $3,009 if profit-taking emerges."

Ethereum Fundamentals Strengthen Amid Institutional Interest

Three key developments are shaping ETH sentiment: 1) The gas limit increase improves network throughput, 2) A Coinbase hacker's accumulation suggests confidence in further upside, and 3) BlackRock's staking proposal could bring institutional inflows.

"These catalysts align with our technical outlook," notes BTCC's Emma. "The BlackRock news particularly validates the $5,000 price prediction circulating among bulls."

Factors Influencing ETH's Price

Ethereum Enhances Network Capacity with Gas Limit Increase

Ethereum's network capacity has taken a significant leap forward as co-founder Vitalik Buterin announced a gas limit increase to 37.3 million units. Nearly half of all staked ETH now supports pushing this limit to 45 million, signaling strong validator consensus for scaling Layer 1 throughput.

The protocol's built-in 0.1% per-block adjustment mechanism allows validators using compatible client software to organically drive this expansion. While boosting transaction processing capability, the move raises questions about maintaining decentralization as hardware requirements for node operators intensify.

Coinbase Hacker Aggressively Accumulates Ethereum Amid Market Surge

A hacker linked to one of Coinbase's largest data breaches has been aggressively accumulating Ethereum (ETH) as prices surge. In July, the attacker purchased 649.62 ETH for $2.31 million at an average price of $3,561 per token, following an earlier acquisition of 4,863 ETH for $12.55 million in the same month. The wallet, identified by blockchain analytics platform Lookonchain, previously sold 26,762 ETH in May for $69.25 million before reversing course to buy back into the market.

The hacker's portfolio, built at an average cost of $2,600 per ETH, now holds millions in unrealized gains as Ethereum's price exceeds $3,700—a 40% monthly increase. Transactions were primarily executed via the CoW Protocol, a strategy likely aimed at reducing visibility and minimizing slippage. The move signals a calculated bet on Ethereum's bullish momentum, aligning with broader market optimism.

The breach, enabled by a now-patched security flaw, initially caused over $300 million in damages. Despite the illicit origins of the funds, the hacker's trading activity underscores Ethereum's growing appeal as a high-value asset in volatile markets.

Ethereum Price Prediction: BlackRock's ETH Staking Proposal Could Catalyze $5000 Surge

Ethereum's recent breakout above $3500 has reignited bullish sentiment, with analysts projecting a potential climb to $5000 this year. The catalyst? BlackRock's pending Ethereum ETF staking proposal, which could unlock billions in institutional liquidity.

Market observers note striking parallels to Bitcoin's ETF-driven inflows. Approval of BlackRock's proposal may funnel up to $10B into ETH, mirroring Bitcoin's post-ETF trajectory. This institutional tailwind could validate even the most optimistic price predictions circulating among crypto analysts.

The proposal's staking component adds a critical dimension. By enabling yield generation within a regulated wrapper, it addresses a key institutional requirement - something traditional finance has lacked until now. This structural advantage may accelerate adoption beyond what Bitcoin ETFs achieved.

Is ETH a good investment?

Based on current technicals and fundamentals, ETH presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +25.8% premium | Strong uptrend |

| Bollinger Position | Upper band | Overbought (watch for pullback) |

| MACD | Converging | Bearish momentum fading |

"ETH's risk-reward looks favorable above $3,500 support," says BTCC's Emma. "The $5,000 target appears achievable within 6-12 months given institutional adoption."

Cryptocurrency investments are volatile. Conduct your own research before investing.